![]() By:Shree1news, 07 JAN 2022

By:Shree1news, 07 JAN 2022

Union Minister of Finance & Corporate Affairs Smt. Nirmala Sitharaman reviewed the performance of Public Sector Banks (PSBs) with their Chairmen & Managing Directors (CMDs/MDs) via virtual mode in New Delhi today. The review meeting was also attended by Union Minister of State for Finance Dr Bhagwat Kisanrao Karad and Secretary, Department of Financial Services (DFS), Shri Debasish Panda, along with senior officials of the DFS.

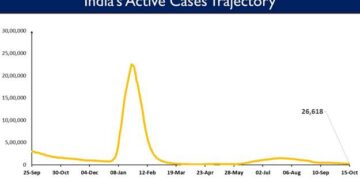

During the review meeting, Smt. Sitharaman assessed various steps taken by PSBs in implementing pandemic-related measures initiated by Government of India and Reserve Bank of India (RBI) and readiness to tackle possible future disruptions that may occur due to the ongoing variant of the COVID-19 pandemic.

While appreciating the success of ECLGS, the Finance Minister said that it is not time yet to rest on our achievements and that our collective efforts must strive towards supporting sectors that face interruption due to continued onslaught of COVID-19 pandemic. Smt. Sitharaman also conveyed to the bankers to continue supporting agriculture sector, farmers, retail sector and MSMEs.

Smt. Sitharaman noted that business outlook is progressively improving in spite of the headwinds from global development and Omicron spread. The Finance Minister underlined that contact intensive sectors may require more support to help them fight against the pandemic.

On the credit demand front, the Finance Minister said that credit demand is expected to pick up on account of growth in retails segments, improvement in overall macroeconomic prospects and improving financial health of borrowers.

During the review meeting, bankers pointed out that PSBs have observed an improvement in the repayment culture in the country.

PSBs have performed well and, supported by various policy measures, provided the required impetus to the economy for coming out of shackles of pandemic induced stress.

Performance of Public Sector Banks (PSBs) —

- PSBs recorded net profit of Rs 31,820 crore in FY 2020-21, highest in last 5 financial years.

- Net profit of Rs 31,145 crore for the first half of FY2021-22, almost equal to that of FY 2020-21.

- PSBs have effected a recovery of Rs 5,49,327 crore during the last 7 financial years.

- PSBs are adequately capitalised and CRAR of PSBs as on September 2021 is 14.4%, against regulatory requirement is 11.5% (including CCB).

- CET1 of PSBs was at 10.79% as on September 2021 against regulatory requirement is 8%.

- PSBs recorded year-on-year credit growth of 11.3% in personal loans, 8.3% in agriculture loans and overall credit growth of 3.5%, as on September 2021.

- Under Credit Outreach Programme launched in October 2021, PSBS have sanctioned an aggregate loan amount of Rs. 61,268 crore.

- During the COVID-19 pandemic, PSBs have performed well in various Government schemes like ECLGS (launched in May 2020 to provide relief particularly to the MSME sector amidst the COVID-19 pandemic), LGSCAS and PM SVANidhi.

- Of the extended limit of Rs. 4.5 lakh crore of ECLGS provided by the Government, 64.4% or Rs 2.9 lakh crore, sanctioned upto Nov. 2021. Over 13.5 lakh small units survived pandemic due to ECLGS, saved MSME loans worth Rs 1.8 lakh crore from slipping into non-performing assets, and saved livelihood for approx. 6 crore families.

In their assessment of overall situation, bankers were confident that PSBs are adequately capitalised and banks are prepared for any stress scenarios in future.

The Finance Minister also thanked the bankers for extraordinarily supporting the country from the start of the COVID-19 pandemic. She attributed the success of ECLGS to the collective efforts of the banking community. Smt. Sitharaman appealed to the banking community to observe COVID-19 appropriate behaviour for the safety of their staff & families and ensure that everyone is vaccinated.

In his address to the bankers, Union Minister of State Dr Bhagwat Karad said that PSBs are the power engines of our economy and congratulated the bankers for their performance during the pandemic times. Dr Karad said that moving with the times, banking has become more open and customer centric.

Earlier at the start of review meeting, SBI Chairperson gave an in-depth presentation on pre-pandemic and current scenario of banking business to the Finance Minister. Later, CMDs/MDs of various PSBs also shared their views on the overall assessment of the banking business and gave various suggestions for overall growth of business.

Source: PIB

Finance

Finance