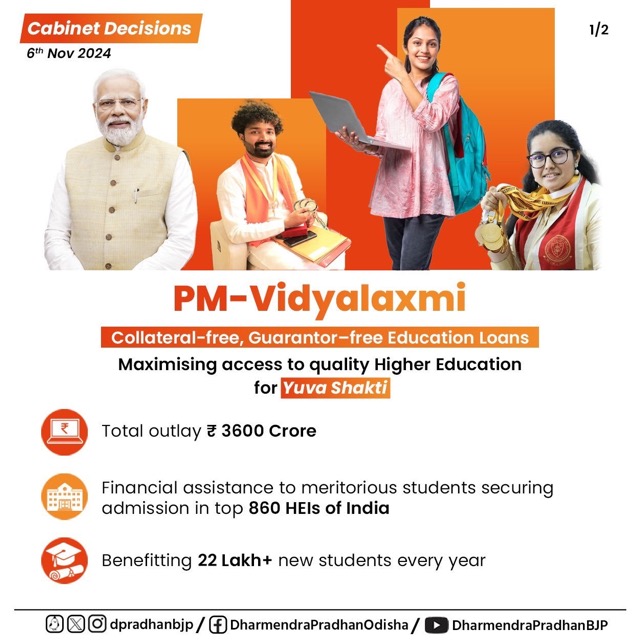

The PM Vidyalaxmi Scheme, announced on Wednesday, is a new Central Sector scheme aimed at providing financial assistance to students so that financial restrictions do not prohibit them from pursuing higher education.

Under the PM Vidyalaxmi initiative, any student admitted to a Quality Higher Education Institution (QHEI) will be eligible for collateral-free and guarantor-free loans from banks and financial institutions to cover the entire cost of tuition and other course-related expenditures.

PM Vidyalaxmi Scheme: Who can apply?

The scheme would be available to India’s best higher education institutions (HEIs) based on NIRF rankings. Eligible institutions include all government and private HEIs listed in the top 100 in overall, category-specific, and domain-specific NIRF rankings, as well as state government HEIs ranked 101-200 and all central government institutions. This list will be updated annually with the most recent NIRF rankings. PM-Vidyalaxmi would initially feature 860 eligible institutions, serving over 2.2 million students, with the ability to provide benefits to interested students.

Students can acquire a 75% credit guarantee on outstanding defaults for loans up to Rs 7.5 lakh through the initiative, which helps banks provide these educational loans.

Furthermore, students with an annual family income of up to Rs 8 lakh who are ineligible for other government scholarships or interest subsidies can receive a 3% interest subsidy on loans up to Rs 10 lakh during the moratorium. This interest subsidy will be awarded to 100,000 students per year, with a preference for those attending government schools and pursuing technical or professional courses. A budget of Rs 3,600 crore has been allotted for 2024-25 to 2030-31, with 7,00,000 new students likely to benefit from the interest subsidy throughout this time period.

PM Vidyalaxmi Scheme: How to apply

The Department of Higher Education will launch a unified portal – PM-Vidyalaxmi, where students can apply for education loans and interest subsidies through a streamlined application process accessible to all banks. The interest subsidy will be disbursed via E-vouchers and Central Bank Digital Currency (CBDC) wallets.

Application to Vidyalaxmi Scheme can be done by following these steps:

Step 1: The applicant will have to register and login to Vidya Lakshmi portal

Step 2: Fill-up the Common Education Loan Application Form (CELAF) by providing all the necessary details

Step 3: After filling the form, the applicant can search for Educational Loan and apply as per his/her needs, eligibility and convenience

Alternatively, the applicant can also search for Educational Loan after login and apply for the suitable Educational Loan by filling the CELAF.

PM-Vidyalaxmi seeks to enhance and deepen the impact of the Government of India’s education and financial inclusion programs during the last decade, with a particular emphasis on increasing access to quality higher education for India’s youth. This program will supplement the Central Sector Interest Subsidy (CSIS) and the Credit Guarantee Fund Scheme for Education Loans (CGFSEL), both components of the PM-USP and supervised by the Department of Higher Education.

During the moratorium period, students with an annual family income of up to Rs 4.5 lakh participating in technical or professional courses at authorized institutions can obtain a full interest subsidy on education loans of up to Rs 10 lakh via the PM-USP CSIS.

Source:IE

Finance

Finance