![]() By: Shree1news, 16 JAN 2021

By: Shree1news, 16 JAN 2021

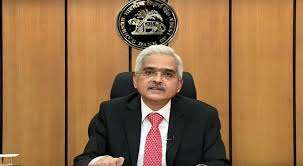

Reserve Bank of India Governor Shaktikanta Das on Saturday mentioned the central bank can think about the idea of a bad bank if there is any such proposal.

Delivering the Nani Palkhivala Memorial lecture, the RBI governor mentioned the government and private players need to plan for it. “If there is a proposal to set up a bad bank, the RBI will look at it. We have regulatory guidelines for ARCs (asset reconstruction companies). We are open to look at any proposal to set up a bad bank. If any proposal comes, we are open to examine it,” mentioned Das.

The thought of establishinga badbankis one of the proposals submitted by the Confederation of Indian industries in its pre-budget memorandum to the government. On 19 December, Economic Affairs Secretary Tarun Bajaj had mentionedthe government is exploring all options, includingsetting up of a badbank, to improve the health of the country’s banking sector.

A bad bank bundles up all of the bad assets of financial institutions at a reduced worth and sells it to investors by putting a turnaround plan in place. Indian Banking Association (IBA) had submitted a proposal to each the Government and the RBI to arrange a national level asset reconstruction company with the government infusing capital worth ₹10,000 crore.

The idea of forming a ‘bad bank’ in India was initially floated in January 2017 when the Economic Survey of India suggested setting up a Public Sector Asset Rehabilitation Agency (PARA). RBI, too, got here up with a suggestion to kind two entities to scrub up the bad loan problems ailing PSBs — PAMC (Private Asset Management Company) and NAMC (National Assets Management Company).

In 2018, the federal government proposed a five-pronged technique below Undertaking Sashakt to sort out stress within the banking sector, and had fashioned a panel led by Mehta, the non-executive chairman of Punjab Nationwide Financial institution (PNB). Below the undertaking, the committee needed to float an AMC and an AIF to resolve non-performing property (NPAs) over ₹ 500 crore.

On Saturday, Das also mentioned the central bank will roll out measures on enhancing governance in banks and non-banks over the following few months and weeks. He mentioned the current incidents have highlighted the function of promoter, shareholders and senior administration in governance. Greater RBI supervision is required to make sure high quality of governance, he mentioned.

Talking on the current global capital flows, Das mentioned emerging market economies have been constructing forex reserves into order to cushion themselves from any global spillovers. To mitigate world spillover, economies haven’t any recourse however to construct their own forex reserve even thought at the cost of being included within the currency manipulator list of US treasury. “This aspect needs greater understanding on both sides so that EMEs can actively use policy tools to overcome capital flow related challenges,” he mentioned.

Source:A-N

Finance

Finance