The Reserve Bank of India’s (RBI) newly reconstituted Monetary Policy Committee (MPC), which met from October 7-9, maintained the key policy rate – the repo rate – at 6.5 percent on Wednesday for the tenth consecutive monetary policy review.

While the six-member MPC revised its monetary policy stance from ‘removal of accommodation’ to ‘neutral’ during the policy meeting, the panel left retail inflation and GDP growth forecasts unchanged at 4.5 percent and 7.2 percent for FY2025, respectively.

The RBI’s policy panel voted 5:1 to keep the repo rate unchanged. Nagesh Kumar, Director and Chief Executive of the Institute for Studies in Industrial Development, voted to lower the repo rate by 25 basis points.

RBI Governor Shaktikanta Das stated that inflation is projected to rise significantly in September due to adverse base effects and rising food costs. The headline inflation trajectory will moderate sequentially in the fourth quarter, but Das warned that unexpected weather events and geopolitical concerns would continue to provide significant upside risks to inflation.

The RBI’s decision to shift its policy stance from withdrawal of accommodation indicates that it would not take actions to restrict the money supply in the economy. The agency was withdrawing its accommodative approach to reduce inflation while boosting growth.

However, the MPC stated that its policy stance will remain “unambiguously focused on a durable alignment of inflation with the target” while promoting growth. The RBI’s shift to a ‘neutral’ stance is a watershed moment in its strategy, allowing more flexibility in handling changing economic situations.

Because the RBI has kept the repo rate stable at 6.5 percent, all external benchmark lending rates (EBLR) linked to the repo rate would not rise, providing respite to borrowers as their equivalent monthly installments (EMIs) will not rise.

However, lenders may boost interest rates on loans tied to the marginal cost of fund-based lending rate (MCLR) if the complete transmission of a 250-bps increase in the repo rate between May 2022 and February 2023 does not occur.

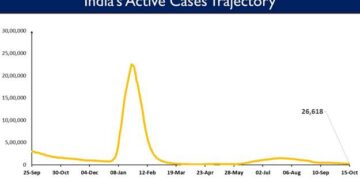

The RBI Governor stated that the September inflation print is projected to show a significant increase due to unfavourable base effects and a pick-up in food price momentum induced by the lingering impacts of a shortage in onion, potato, and chana dal (gram) production in 2023-24, among other factors. The headline inflation trajectory, however, is expected to sequentially decline in Q4 of this year due to a good kharif harvest, adequate cereal buffer inventories, and a predicted good crop in the ensuing rabi season.

Unexpected weather catastrophes and the development of geopolitical disputes pose significant upside risks to inflation. International crude oil prices became turbulent in October. The recent increase in food and metal prices, as indicated in the Food and Agricultural Organisation (FAO) and World Bank price indices for September, if sustained, might increase the upside risks, Das said.

In reaction to the 250-bps boost in the policy repo rate since May 2022, banks have raised their repo-linked external benchmark-based lending rates (EBLRs) by a similar amount. The one-year median MCLR of banks increased by 170 basis points from May 2022 to August 2024.

The RBI is expected to decrease the repo rate for the first time in December 2024. “If food inflation moderates, we could see a 50 basis-point rate cut in the upcoming policy meetings this fiscal year.” The MPC will be cautious about the changing threats to food inflation. Although core inflation has remained quite low, increased food inflation has kept headline figures high,” CareEdge Ratings stated.HSBC sees Repo rate cuts of 25 bps each in the December and February meetings, taking the repo rate to 6 per cent. “Slowing growth and falling inflation offer room for the RBI to cut rates in coming months. We expect repo rate cuts of 100 bps by December 2025, beginning December 2024,” Bank of America said.

Source:IE

Finance

Finance