![]() By: Shree1news, 30 OCT 2021

By: Shree1news, 30 OCT 2021

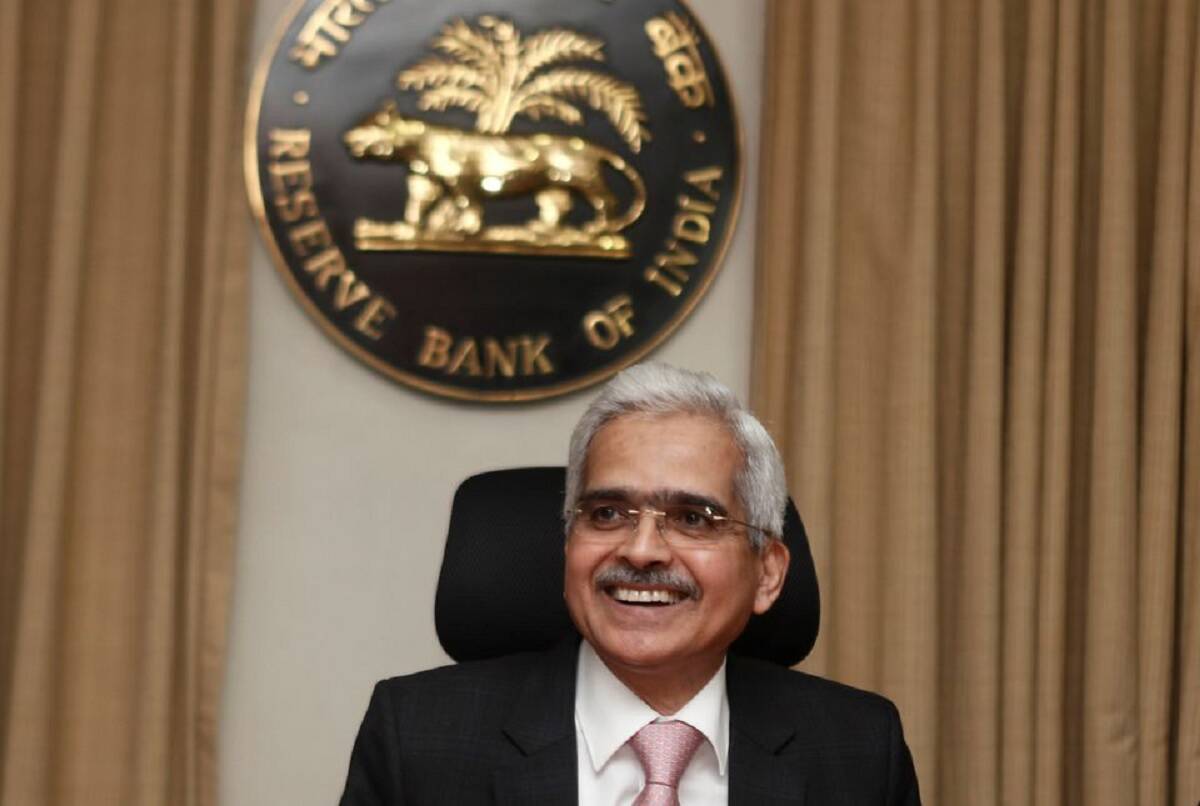

The government late Thursday reappointed Shaktikanta Das governor of the Reserve bank of India (RBI) for 3 years, signalling its approval of the rules pursued with the aid of the imperative bank during the as soon as-in-a-century pandemic disaster.

“The Appointments Committee of the cabinet has authorised the reappointment of Shri Shaktikanta Das, lAS Retd. (TN:80) as Governor, Reserve financial institution of India for a period of 3 years beyond 10.12.2021 or till further orders, whichever is earlier,” a notification issued by the Appointments Committee read.

A retired Indian Administrative services (IAS) officer, Das had assumed rate because the 25th governor of the RBI effective December 12, 2018.

before this he served as a member of the 15th Finance fee for a year. If Das completes his six-year tenure, he will be the longest-serving RBI governor since Benegal Rama Rau, who served as head of the crucial bank between July 1, 1949, and January 14, 1957.

Bimal Jalan served as governor months short of six years — between November 22, 1997, and September 6, 2003. No other governor since Jalan has served for over five years. Das’ full tenure will see him through the overall elections in 2024. Das’ reappointment will make certain policy continuity, economists stated.

“The RBI under Das demonstrated exemplary stewardship in cushioning the economy and financial markets from the heavy blow of Covid-19. The reappointment will ensure coverage continuation, decisive and innovative coverage initiatives, and effective communication with a wide spectrum of stakeholders,” stated Siddhartha Sanyal, leader economist of Bandhan financial institution.

Economists and bond market dealers now expect an imminent reverse repo hike, likely in December itself, as a signal of policy normalisation. without knowing of his continuance at the RBI, Das could have been circumspect in taking bold policy calls, analysts stated.

With the repo fee at 4 in line with cent, and the reverse repo at 3.35 in step with cent, the policy rate corridor has widened to 65 basis factors from its usual 25 basis points. This needs to be introduced back to 25 basis points.

The central bank has started out its normalisation exercise no matter being careful in terming it as such. in lots of ways, the RBI has observed regulations of central banks of advanced countries, shaping them according with India’s necessities.

“the next 3 years can be equally crucial for the governor. in particular, the current dispensation on the RBI has firmly stamped a new discourse in monetary policy through adopting a discretion-based coverage approach and putting the RBI at the same pedestal with the eu central bank and US Federal Reserve, which became hitherto absent,” said Soumya Kanti Ghosh, group chief economic advisor at state bank of India.

like the US Fed, the RBI under Das is taking baby steps toward coverage normalisation. in the October monetary policy, the central bank stopped in addition liquidity infusion, and then with a better amount of variable rate opposite repo (VRRR), which will run up to Rs 6 trillion in December, the central bank will slowly cast off the liquidity.

On Wednesday, the central bank introduced a 28-day VRRR, in addition to its 14-day VRRRs. The concept is to keep liquidity out of the system for a longer duration. VRRR, as Das had explained in his speech at some point of the economic coverage press conference, is voluntary, but given the incentive of higher returns, all the past VRRRs were successful.

apart from policy normalisation, the central bank has different urgent issues that the governor is predicted to cope with, as an example, the bad debt problem of Indian banks.

The RBI expects bad debts to rise for Indian banks due to Covid-related stresses. the coolest factor, but, is that banks are thoroughly capitalised to address deterioration in asset high-quality.

beneath the RBI’s macro stress tests, the gross non-performing asset (GNPA) ratio of the banking system can also increase from 7.48 consistent with cent in March 2021 to 9.80 per cent by using March 2022 under the “baseline” scenario, and to 11.22 per cent under a “severe stress” scenario, however banks have enough capital to attend to it “both at the aggregate and individual level, even below strain”, the half-yearly financial stability report (FSR), launched by the RBI in July, said.

The RBI governor have to oversee Indian bonds’ inclusion in global bond indices and cope with the consequent liquidity inflow, estimated to be at least $30 billion a 12 months.

How the RBI below Das handles the growing presence of big Tech, and disruptive fintech, within the banking space will be watched.

underneath Das, the RBI has embarked on an aggressive policy of reserve accumulation because the RBI governor sees that as the best coverage towards coverage flip-flops by using developed country central banks which include the us Federal Reserve, which is taking the first steps towards the tapering off of its monthly $one hundred twenty billion bond buy programme.

The RBI has to control the record-high market borrowing programmes of the authorities, which crossed the Rs 12 trillion mark for two successive years because of the Covid strain.

Finance

Finance