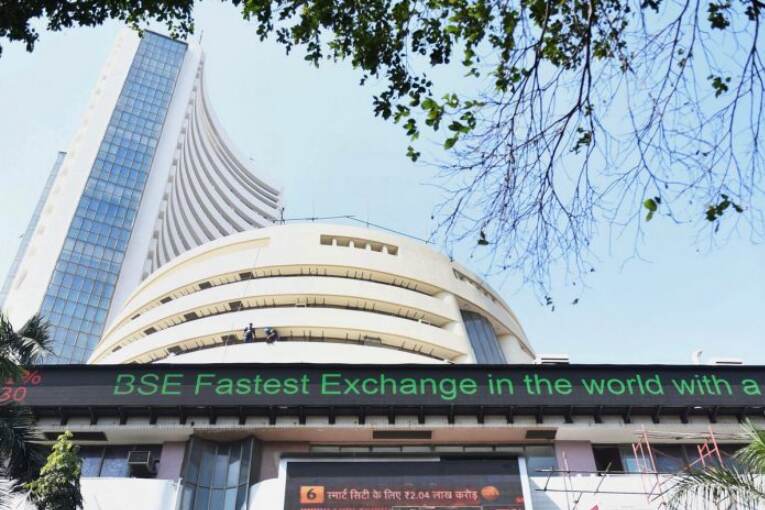

Stock Market Highlights: Indian equity benchmarks BSE Sensex and NSE Nifty50 ended a volatile session nearly one percent lower on Wednesday, amid weakness across global markets as focus returned to the possibility of aggressive monetary policy tightening. Losses in financial and IT shares pulled the headline indices lower, though gains in metal and oil & gas counters limited the downside. Broader markets stayed in the green throughout the day, with the Nifty Midcap 100 index rising 0.6 percent and its smallcap counterpart edging up 0.1 percent. Investors globally awaited minutes of the FOMC’s last policy meeting due later in the day, and kept an eye out on news updates about the Russia-Ukraine war.

Some highlights:

- HDFC Bank, HDFC drag market for 2nd day

- Metal, power stocks rise; Coal India, NTPC top Nifty gainers

- PSU banking stocks jump in last hour of trade; Nifty PSU Bank rises 2 percent

- Indian Hotels, Tata Power, Vedanta, Bank of Baroda, Delta, JSPL, IDFC hit 52-week highs

- IT stocks under pressure ahead of earnings; HCL, Tech Mahindra, Infosys down 2 percent

- IRCTC falls 4 percent on reports of government selling over 3 percent via OFS

- Marico slips 4 percent after co indicates low single-digit revenue growth in Q4

- RBL Bank shares in the red but off day’s low following Q4 update

- Rain Industries slips 4 percent on partial shutdown of Visakhapatnam calciner plant

- Yes Bank surges 16 percent with large volume

- Midcap outperformance keeps market breadth in favour of bulls; NSE advance-decline ratio at 2:1

Finance

Finance