Following four days of consecutive losses, benchmark equity indices rose in Thursday’s session in a relief rally in response to the US Fed’s rate hike action and dovish commentary from Fed chair Jerome Powell. However, sentiment quickly turned negative, and benchmark indices fell in line with global peers.

Global equities fell after the Federal Reserve raised its key interest rate by three-quarters of a point and signaled that more rate hikes were on the way to combat runaway inflation. European benchmarks and futures in the United States fell.

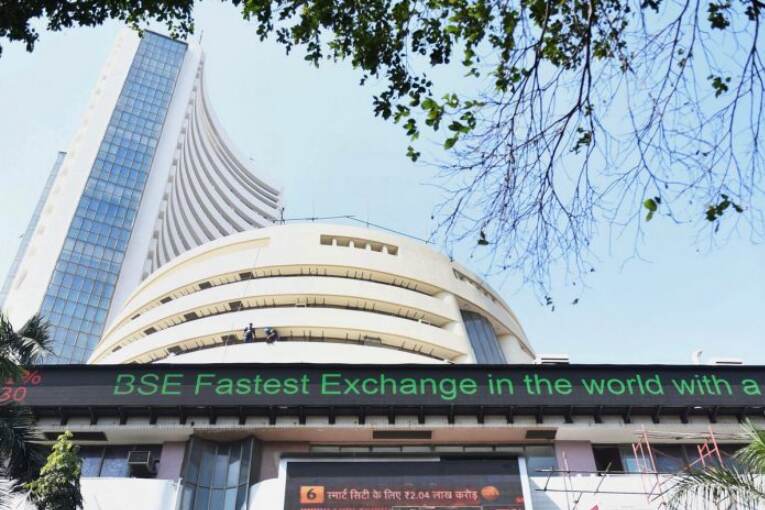

Back home, the Sensex fell 1,045.60 points to 51,495.79, while the Nifty fell 331.55 points to 15,360.60. Approximately 607 shares advanced, 2680 declined, and 97 remained unchanged.

All sectoral indices finished in the red, with the metal index taking the biggest hit, falling more than 5%. Midcap and smallcap indices also ended deep in the red.

Source:Mint

Finance

Finance